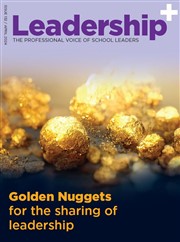

Churches pray for a miracle after wipeout of 'golden' bank shares

Bank of Ireland, once a safe bet, has left many religious institutions counting their losses, writes Jerome Reilly

By Jerome Reilly

Sunday November 23 2008

Just 21 months ago, the Church of Ireland's 2.3 million shares in Bank of Ireland were worth €42m -- had the stock been off-loaded when it reached the historic high of €18 a share.

By Friday morning when the bank's share had actually "rallied" to the heady heights of €1.17 a share the value of the church's portfolio was just €2.7m.

And they are not alone. The disastrous fall in the value of the stock once considered as good as gold has left many in distress.

The Catholic Church, dozens of smaller charities and benevolent organisations have also seen the value of their shares plunge

The Catholic hierachy controls dozens of individual shareholdings in the country's oldest and once most venerable financial institution on behalf of parishes and their parishioners.

A brief examination of the bank's share register shows that Ireland's main church has at least 1.3 million shares in Bank of Ireland that were worth €23m in February of last year but are now valued at less than €1.5m.

There is hardly a Catholic diocese in the country which does not have substantial investments in Bank of Ireland. From the smallest parishes in the country, including many in disadvantaged areas, to small convents and educational trusts, the fall in Bank of Ireland has been a financial disaster.

Dozens of parishes in Dublin, from Gardiner Street to Blackrock, have all incurred paper losses on their Bank of Ireland investments, but the pain is countrywide -- from the dioceses of Armagh, Raphoe and Clogher in the north of the country to Clonfert in the west, Cashel and Emly and Cork, Cloyne and Ross in the south.

The Representative Church Body (RCB) is the charitable trust of the Church of Ireland and manages investments and property, payment of clergy stipends and pensions as well as supporting the core work of the Church by providing finance for the clergy, church pensioners, training of ordinands and education.

The membership of the RCB consists of the archbishops and bishops, members elected by the dioceses and 12 co-opted members usually appointed for their expertise in law and finance.

Investing the Church's funds in rock-solid Bank of Ireland would surely have been viewed as a prudent decision. The bank was regarded as a safe harbour almost guaranteeing long-term growth and as safe as any stock can be from the vagaries of the free market.

The Church of Ireland has four tranches of Bank of Ireland stock -- the biggest amounting to 2,176,315 shares with three smaller holdings of around 14,000, 18,000 and 26,000 shares.

In February of 2007 the value of that portfolio was more than €42m. Now the 2,335,000 shares are worth around €2.7m. Church leaders will be praying that recovery will be swift.

There are institutions all over the country feeling the chill winds of the loss of confidence in bank stock. The City of Galway VEC's 4,573 shares is small in comparison but testament to the mindset that investing in Bank of Ireland was a safe bet.

The churches' confidence in the bank, formed by an Act of Irish Parliament in 1782 to support public and commercial finances in Ireland, is steeped in history and tradition.

From the foundation of the Free State in 1922 until 1971 the Bank of Ireland was the banker of the Irish Government. It was blue chip, safe as houses, austere, well-managed and sensible.

That's why religious congregations and trusts of every denomination and charitable organisations favour the stock so much.

The list includes Ardagh Diocesan Board of Education (DBE) (3,453 shares); Derry DBE (14,651); Kilmore DBE, Co Cavan,(15,680); Leamy Protestant Board of Education, Limerick , (28,727); Limerick DBE (5,308); Ossory DBE (5,367) and the Little Sisters of The Assumption, Blackrock, Cork, (3,755).

Some Catholic dioceses have lost more than others.

The Bishop of Raphoe holds in trust a large number of separate shareholdings purchased at different times in Bank of Ireland on behalf of the diocese and various parishes and schools. The total comes to 265,000 shares in Bank of Ireland.

The Archbishop of Dublin has also invested parish funds heavily in Bank of Ireland through the Church's legal and property vehicle, the St Laurence O'Toole Diocesan Trust.

The parishes in the east of the country now looking at a substantial decrease in value following their plunge into the stock market include: Meath Street (24,420 shares); Halston Street (10,368); City Quay (29,935); Francis Street (45,435); Pro-Cathedral (27,336); Pro-Cathedral (second holding) (45,236); Archbishop's House (12,787); Blackrock (3,114); Booterstown (18,093); Gardiner Street (39,744); Castledermot (7,624); Donnybrook (45,236); Fairview (4,642); Blessington (7,115); Bray (22,581); St Michael and St John's (20,736); Wicklow (1,383); Westland Row (56,207); Berkely Road (10,368); Rathfarnham (10,595) and St Anthony's (12,715).

The Bishop of Clonfert has also invested in 48,057 shares on behalf of his diocese while the Bishop of Ardagh is the nominal owner on behalf of his diocese of 25,442 shares.

State agencies have also invested money left in bequests in Bank of Ireland in shares. The Department of Education Reid Bequest which offers awards to schools and Leaving Certificate students in Kerry has 2,863 shares once worth more than €50,000 when the BofI share prices was at its zenith but which are now worth less than €3,000 should they be sold.

The Supreme Grand Royal Arch Chapter of the Freemasons based in Molesworth Street, Dublin, and which supports a number of charities, has also learned that shares can go down as well as up with the value of its 8,346 Bank of Ireland shares now worth a fraction of what they were worth 21 months ago.

- Jerome Reilly